san francisco sales tax rate history

The transfer tax rate had been previously unchanged since 1967. The County sales tax rate is 025.

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

San Francisco County California Sales Tax Rate 2022 Up to 9875.

. Get Your First Month Free. Did South Dakota v. The minimum combined 2022 sales tax rate for South San Francisco California is.

For a list of your current and historical rates go to the. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. Notes to Rate History Table.

The December 2020 total local sales tax rate was 8500. You can find more tax rates and allowances for San Francisco County and California in the 2022 California Tax Tables. The current total local sales tax rate in South San Francisco CA is 9875.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. The minimum combined 2022 sales tax rate for San Francisco California is. The California sales tax rate is currently.

The December 2020 total local sales tax rate was 9750. Ad Find Out Sales Tax Rates For Free. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

The California sales tax rate is currently 6. The 2018 United States Supreme Court decision in South Dakota v. Historical Tax Rates in California Cities Counties.

The County sales tax rate is. Rates are for total sales tax levied in the City County of San Francisco. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

The San Francisco County sales tax rate is. The average cumulative sales tax rate in San Francisco California is 864. This is the total of state county and city sales tax rates.

What is the sales tax rate in San Francisco California. These rates may be outdated. The South San Francisco sales tax rate is.

The current total local sales tax rate in San Francisco CA is 8625. What is the sales tax rate in South San Francisco California. How much is sales tax in San Francisco.

This is the total of state county and city sales tax rates. A county-wide sales tax. This includes the rates on the state county city and special levels.

This is the total of state county and city sales tax rates. To review the rules in California visit our state-by-state guide. The Bradley-Burns Uniform Local Sales.

The minimum combined sales tax rate for San Francisco California is 85. 1788 rows California City County Sales Use Tax Rates effective April 1 2022. The current total local sales tax rate in San Francisco County CA is 8625.

San Francisco County Sales Tax Rates for 2022. Has impacted many state nexus laws and sales tax collection requirements. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. San Francisco has parts of it located within.

Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. Payroll Expense Tax. This scorecard presents timely.

Fast Easy Tax Solutions.

How Do State And Local Sales Taxes Work Tax Policy Center

California Sales Tax Rates By City County 2022

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

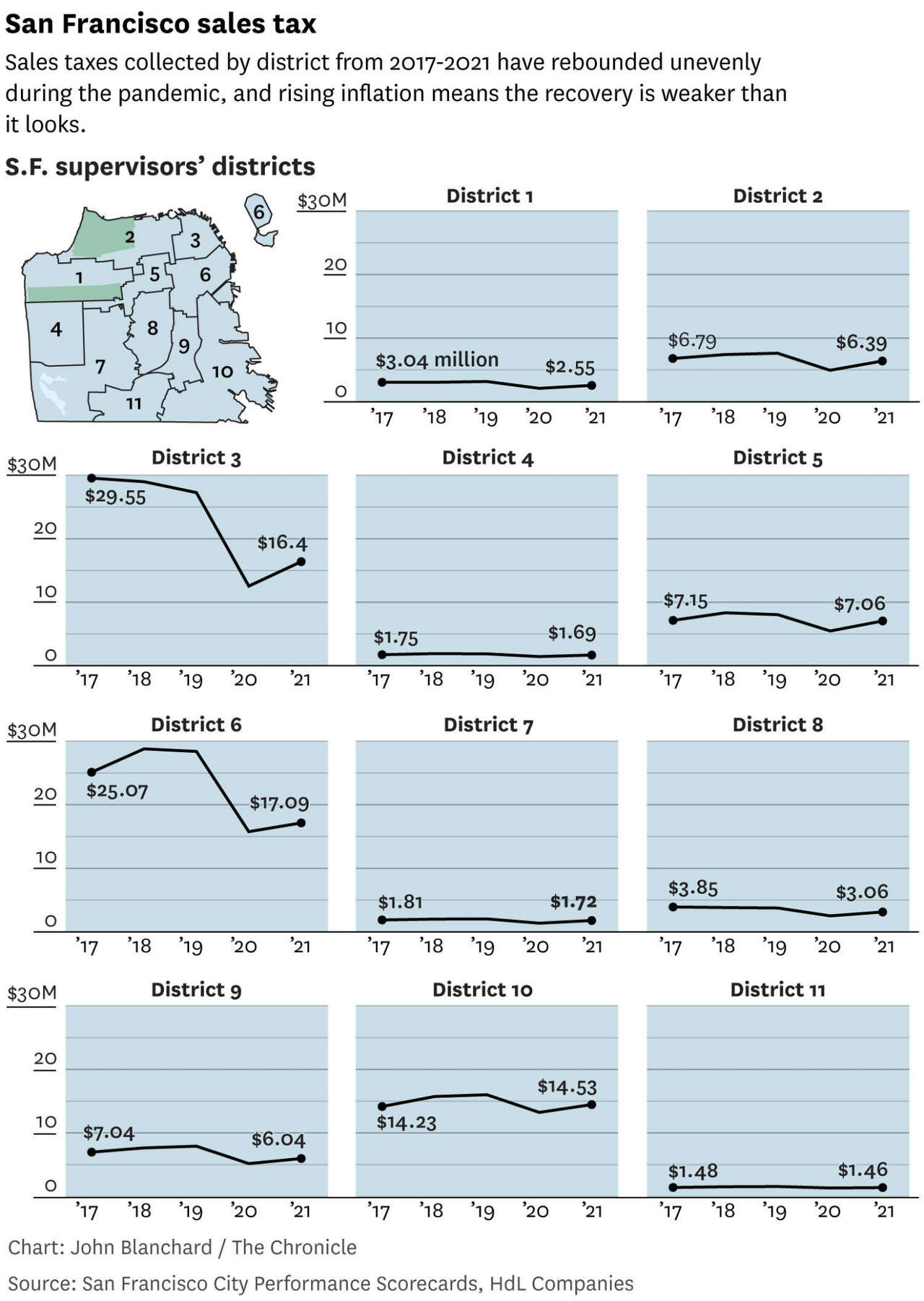

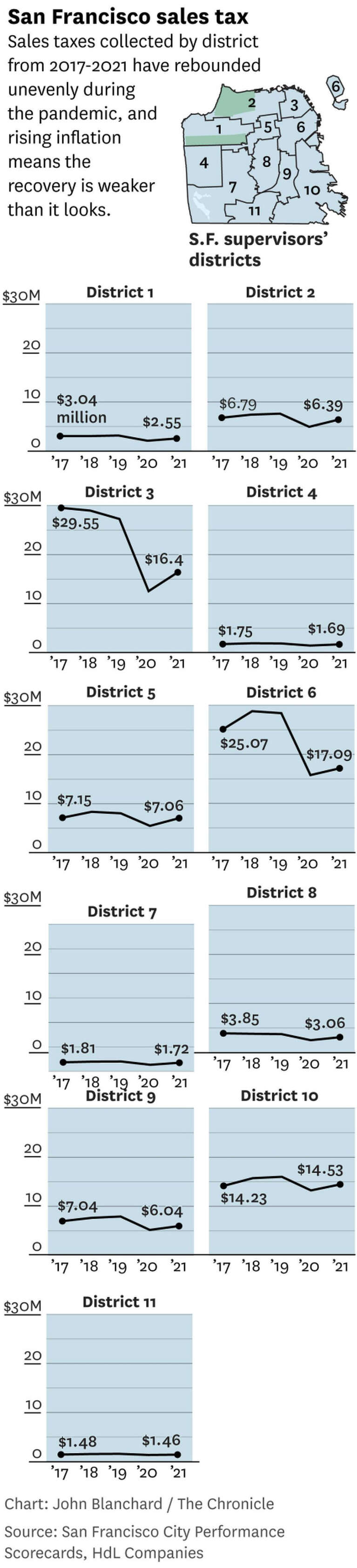

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

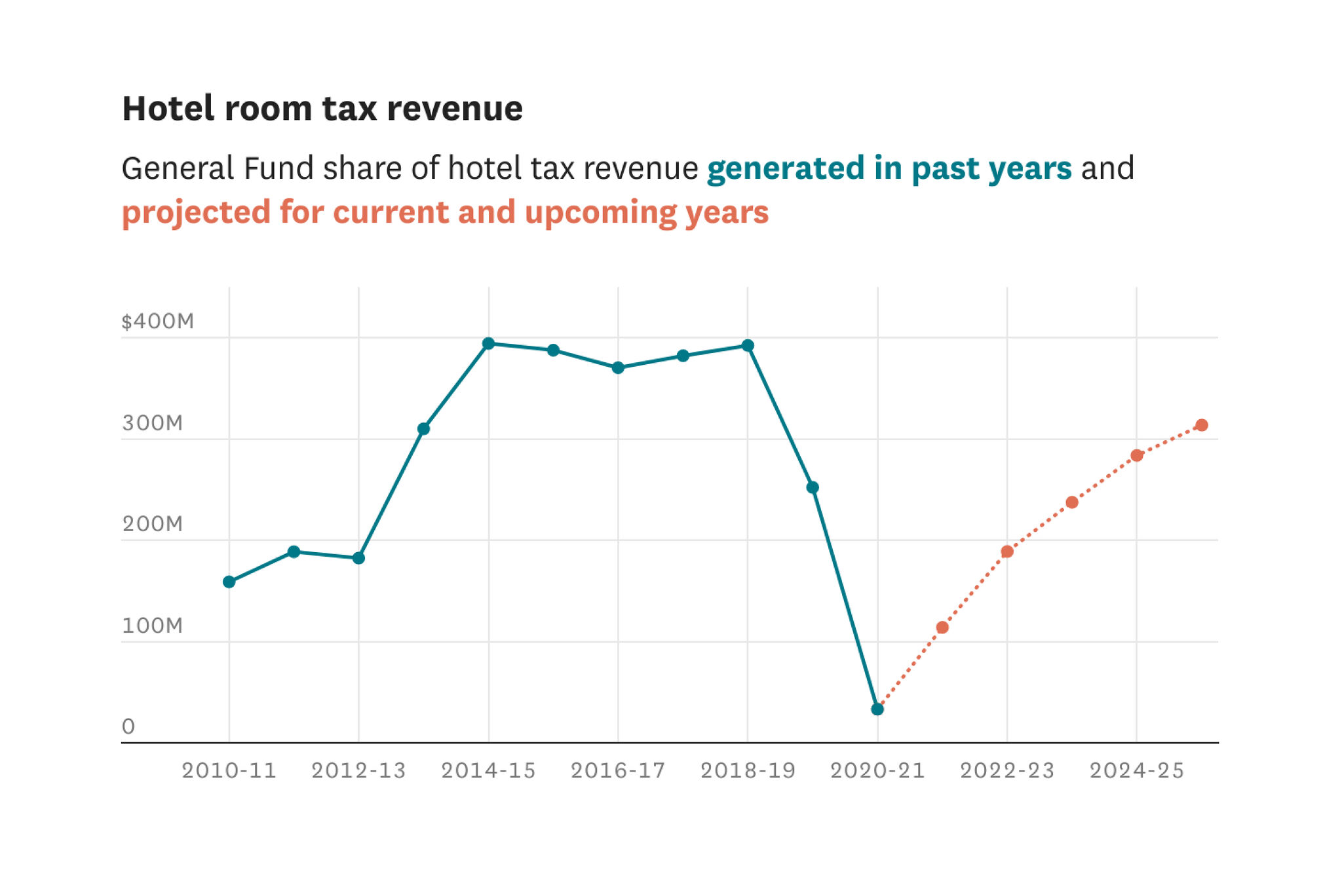

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Understanding California S Sales Tax

Understanding California S Property Taxes

Frequently Asked Questions City Of Redwood City

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

How Do State And Local Sales Taxes Work Tax Policy Center

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Sales Tax

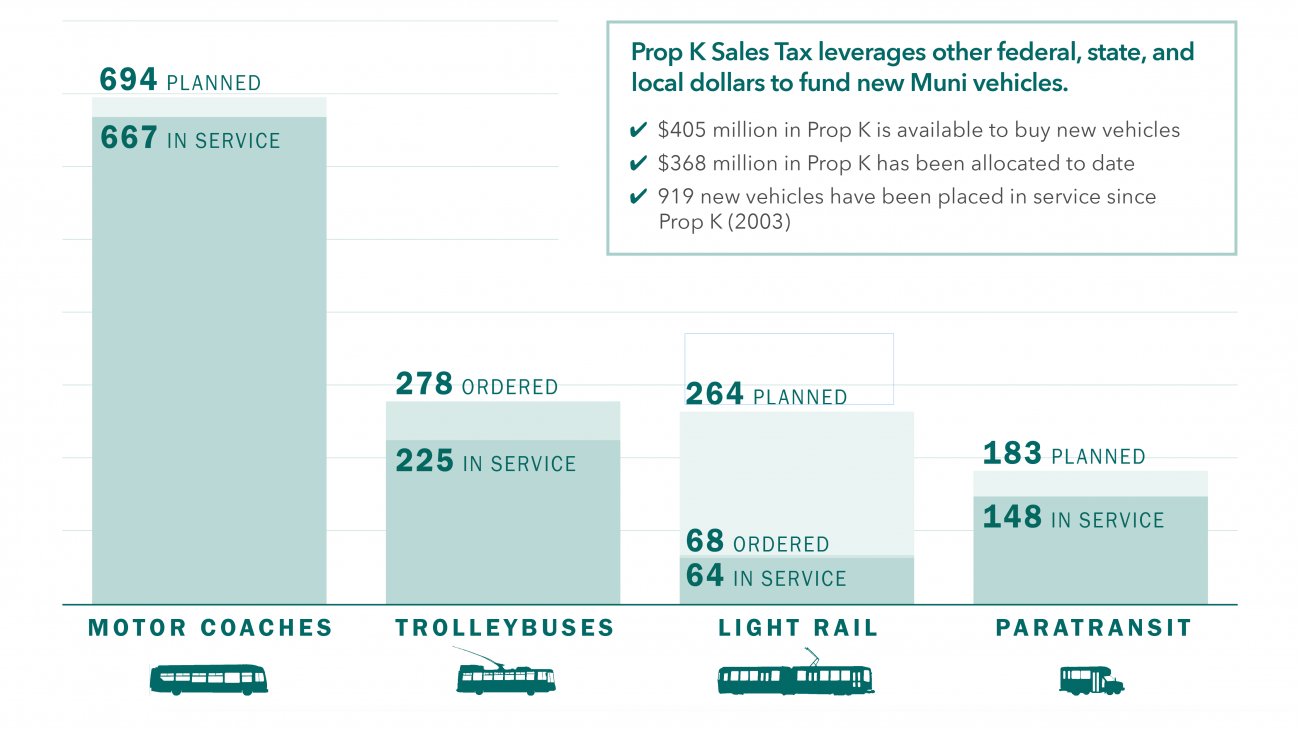

Sales Tax Collections City Performance Scorecards

State High Court Rejects Challenge To S F Property Transfer Tax That Cost A Corporation 12 Million